It has been over six months since my last networth update, lot of changes have occurred since then.

We are now proud (part) owners of a small business. Business operates in a very niche market, there are very few competitors and the overall market size is very small. We have been running the business for over a quarter now and life has been really busy. Managing a full-time job and a business is not easy. It is a steep learning curve and we have not finished learning yet. At some point, I will have to learn to drive a side-sitting forklift and I am not looking forward to that!

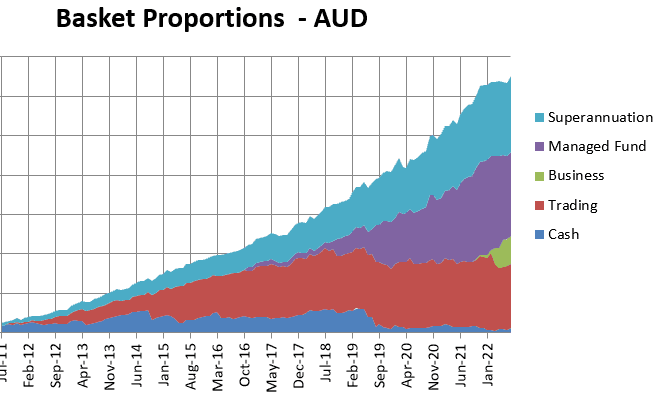

As per our original plan, I emptied the Vangaurd account to fund this acquisition. As it happens in the real world, there are always shortfalls, so had to drawdown some funds from one of the boutique funds. The plan moving forward is to redirect one portion (maybe 25%) of our monthly savings into the boutique fund until it reaches the $-goal and pile the remaining portion of our monthly savings into our active trading account. I need to build up this trading account as I plan to use the funds in our trading account for the next item on our list.

I have made some after-tax voluntary contribution towards my super which I would be claiming against the unused contributions eligible to carry forward provision. Our allocations within the super account has not changed compared to my last update. My view is that we are still in a protracted bear market and bottom is not in, yet.

As one should in a bear market, my trading frequency in the active trading account has reduced drastically. We have not seen an actual capitulation in the markets yet, so I have few small positions geared towards harnessing that capitulation, if it arrives. Other than that, I am in cash at this point in the USD account. In AUD account, I am bagholding a few shitcos, waiting for a greaterfool to relieve me. Lets pray that they turn up at some point.

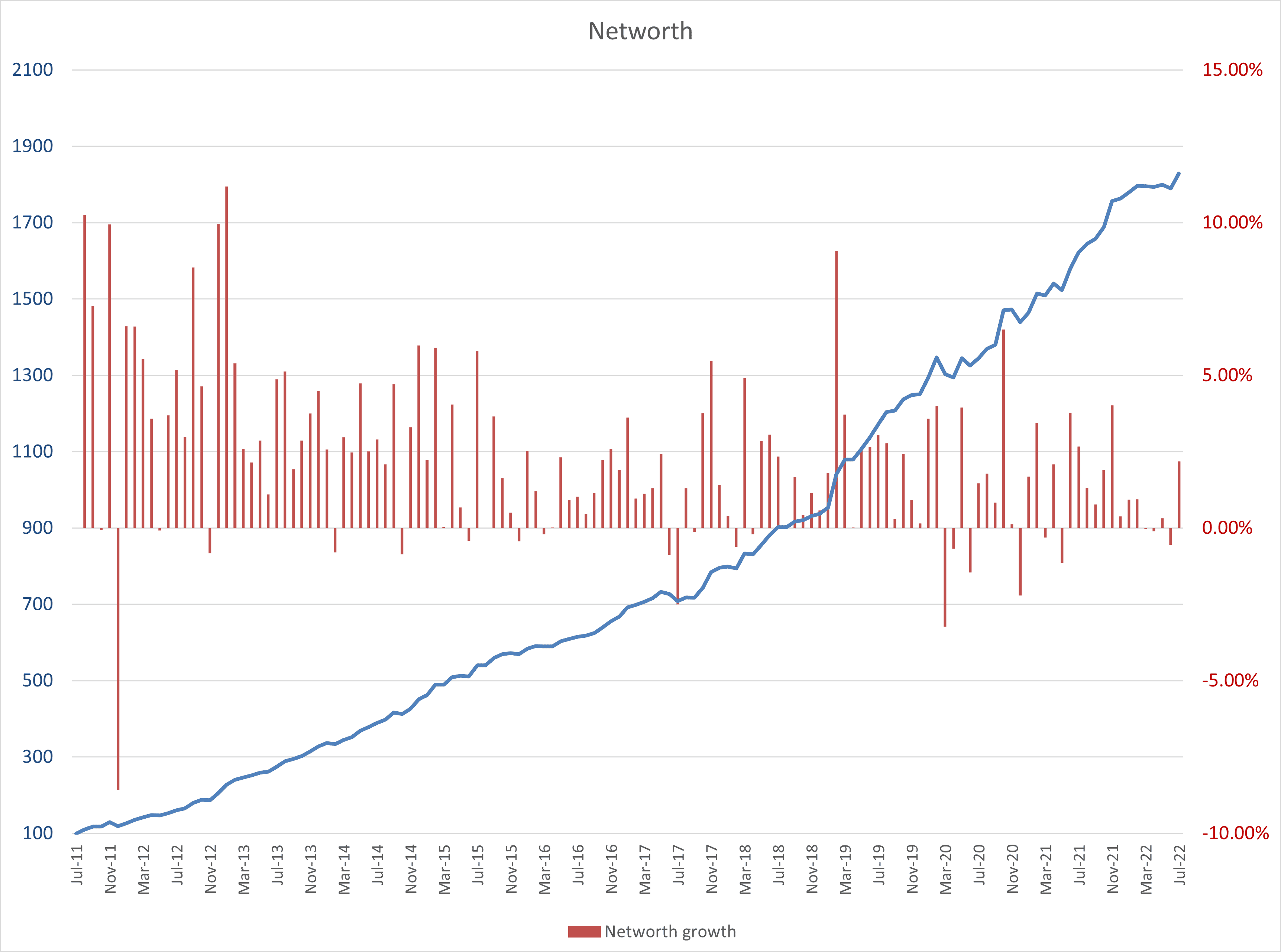

Below is our networth index chart. If you had $100 as of July 2011, it would be $1828 as of July 2022. This is the most simplistic index ever. Compared to a year ago (i.e. July 2021), the index has grown from $1622 to $1828, a moderate 12% growth.

For reference, our portfolio consists of,

Self – sustenance ratio

Our self-sustenance ratio is on track to reach 100% by May 2023! Drawdowns have added an extra 2 months to that projection considering that in December 2021 this was projected to reach 100% by March 2023. I have explained and introduced the concept of self-sustenance ratio in one of my previous blogs.

Currently, it is a smidge over 72% i.e. 4% drawdown on our portfolio would fund 72% of our annual living expenses (including housing, holidays, etc). It is quite a weird feeling looking back to July 2011 when I was starting on this journey and my initial thought was ‘there is no point’. But with some ‘just do it’ attitude and perseverance we will, by May 2023, in 12 short years reach a self-sustenance ratio of 100%! Not a bad feat, in my humble opinion.

Expense summary

I have already shared my expense summary in the previous post so I am not going to do it again. However, the tool I have been using i.e. Pocketbook, will be turned off in Aug-2022. Pocketbook was a simple but great tool, it let you connect to your credit card/bank accounts in order to automatically download transactions and auto-categorise as much as possible. I will miss it.

So, I went on the hunt for a similar tool. Most of the ones that have auto-download feature were paid. So, considering I don’t analyse our spending that often I decided to look for good version which lets me upload the transaction myself i.e. I have to manually download the transactions and then upload to the software tool. I found FireflyIII to be really feature rich but could not get it up and running that easily, so gave up on it.

I then zeroed in on HomeBank, great tool, installs on the local machine. The only negative is, the main visualisation will not let you exclude certain categories. For example, if I am repaying my credit card monthly bill using my bank account, I annotate that transfer as transferring-money. I want this category of transactions to be excluded from the visualisation because it is meaningless to understand my spending pattern. It is not possible to do this on HomeBank. Other than that, it is a fine tool.

That’s it for now.