I have visited Aussie FIRE bug few times and it is quite generous of him/her to have documented their journey building their networth. If you have not visited Aussie FIRE bug, please do yourselves a favour and visit. It is a treasure trove of information.

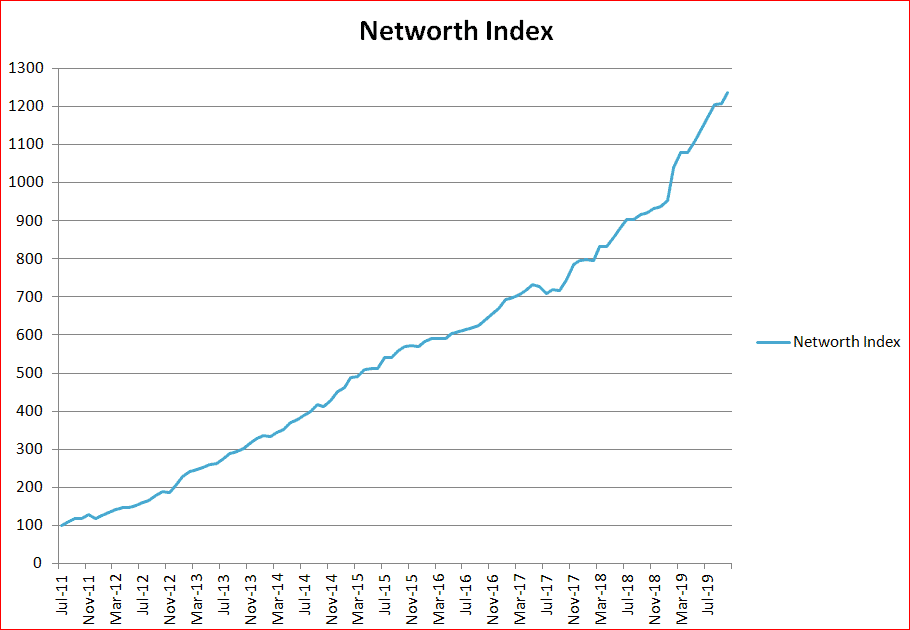

They started their journey in Jan 2011 and as of today their networth is:

Very impressive!

Recently, we reached a financial milestone in our networth building journey. I floated the idea of documenting our journey through a series of blog post to my partner and was shot down. She was not very keen on “revealing our numbers”. Fair enough, I thought. So, voila! I built a networth index!

Before delving into networth index, lets define what is networth and how is it calculated. Networth is sum of your assets (excluding debts) at any given point in time.

Networth = Total value of assets – Total value of debts

The index is quite simple, networth as of first date of record keeping is considered as a reference or baseline for the rest of the series. If x is the networth as of first date of record keeping, then networth index as of today NW = y / x , where y = networth as of today.

So, what is the networth index chart telling us? If you had 100$ as of July 2011, it would be 1200$ as of September 2019. This is the most simplistic index ever, but it is a start.

Conceptually, the rate of growth of networth is a function of income growth, savings growth and investment returns. Therefore, depending on how one’s income grows over time, how their saving patterns change over time and how they allocate their investments and consequently how their investment performs over time will dictate how one’s networth grows over time.

Interestingly, Aussie FIRE bug started their journey around the same time as we did. But, at the outset, it appears to me that they have taken a slightly different route in their asset allocations when compared to us. However, the common theme is diversification and following a set of personal finance rules. The personal finance rule we set ourselves and have since followed are:

- Do not spend more than 30% of our nett income on housing. Lower the better.

- Always save minimum 30% of our nett income. Higher the better.

Our assets are made up of precious metals (physical), chunk in financial markets, superannuation and fixed deposits – all spread across multiple currency / tax jurisdictions except superannuation. With financial markets, I use a chunk to personally trade (via algos and discretionary) and the rest are spread across couple of fund managers.

You might know that 2010 – 2018 has been the longest bull run in the financial markets. Someone could look at our networth index curve and conclude that instead of going through all the trouble of diversification, re-weighting/tracking/monitoring one could have easily achieved the same by riding S&P index! I say to them, absolutely true! In fact, I will go one step further and say that I was too smart for my own good. I started trading having no knowledge or experience trading in financial markets, genuinely thinking that I was very smart and could easily pick it up. Majority of losses and/or drawdowns happened in the chunk that I personally trade (surprise!). In spite of fat losses and red-in-the-eye drawdowns, I was lucky enough to have come out at the other end without becoming bankrupt. If only I had not thought that I was smart then this networth index would have been around 3000 as of today! Hindsight is so wonderful, isn’t it?

I still vividly remember the first row-entry in my excel worksheet, capturing our assets for the first time. It was just five columns, one year-month column, two bank account columns and two superannuation account columns. It took me two minutes to enter and I was thinking to my self this is not going to work, whats the point, etc. Somehow I persisted. I think crossing the mental barrier “whats the point” has been the biggest game-changer in our journey.

Cataloguing and tracking your assets/debts and networth is worthwhile the effort, initially it might appear to be useless exercise but over time you realise the value that it creates. Do not hesitate in starting to document your networth journey.

Just do it. It works.