I’ve been procrastinating and now I finally got around to writing this post. It’s been over six months since my last update, but better late than never, right? 🙂

It is almost coming upto 12 months since we bought a niche business last year. We have been working hard to streamline processes. While we did lose a B2B client, we’ve been building relationships with new clients and investing in an industry certification to gain legitimacy when approaching larger companies. We also launched an online store and have been using Google AdWords to drive sales. While we’re aware that the sustainability of this approach is something to consider, for now, we’re not too concerned about the ROI. We’re also expanding our product range by becoming a retailer for another brand which offers complementary products.

We’ve been putting 25% of our monthly savings into a boutique fund, but now that we’ve reached our goal for that fund, we’ll be re-directing 100% of our savings towards our trading accounts at Vanguard and IBKR. In January 2023, I rebalanced our Super fund composition by deploying a small portion from Cash into Australian and International shares. While I believe we haven’t seen the bottom yet, I’ve started deploying funds because timing the market perfectly is impossible.

I have reduced my trading frequency a lot. I do have a few positions open, amongst them are few shitcos which I am mostly bagholding, some long BBOZ, BBUS, CPER, VIX and short CBA, IWM, SLV. The scariest of them all is my monster VIX option position, fingers crossed, wish me luck! Having said that, 95% of my portfolio is still in cash at the moment with 90% of it in USD and rest in AUD.

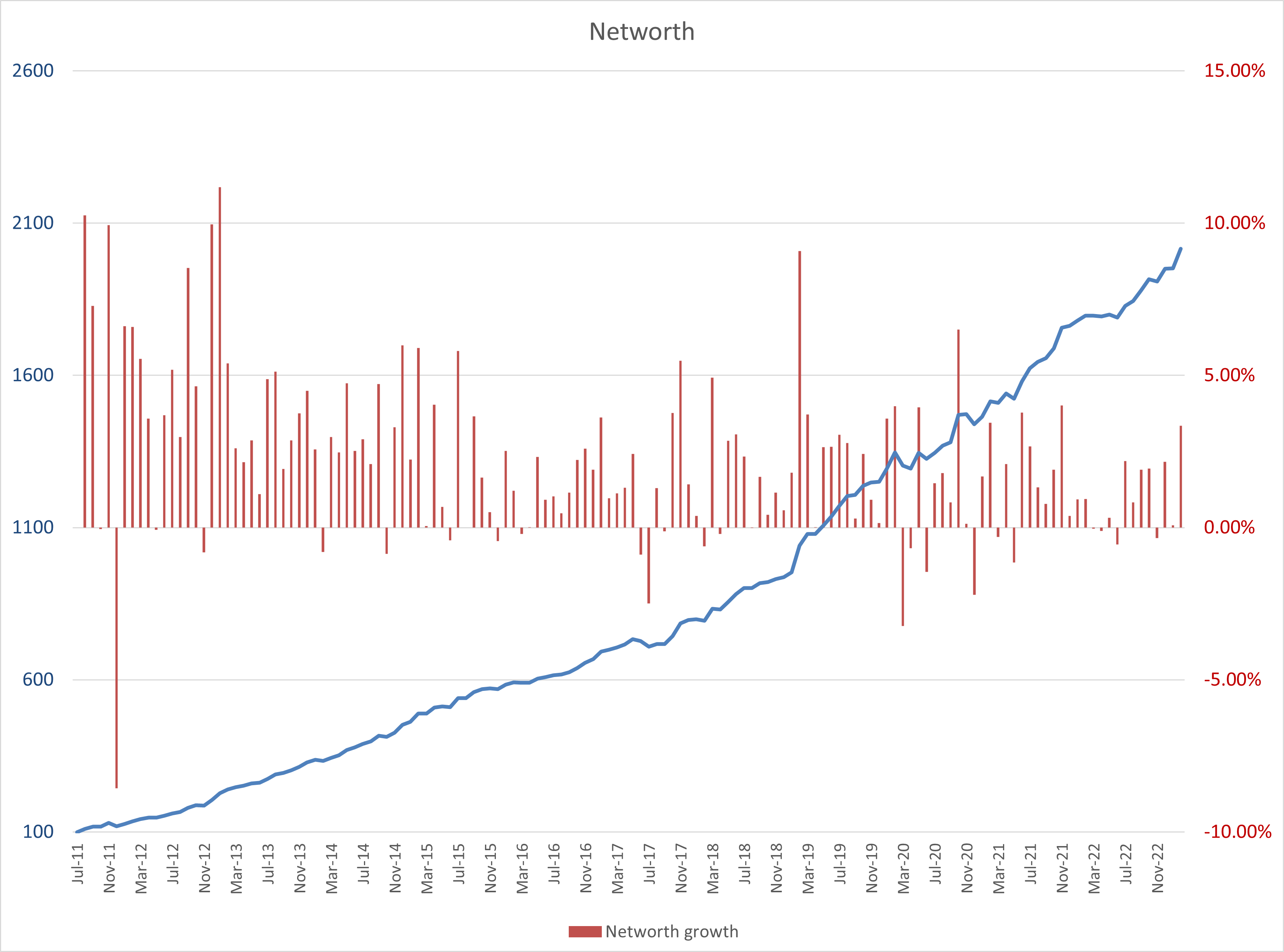

Below is our networth index chart. Compared to a year ago (i.e. February 2022), the index has grown from $1796 to $2016, a moderate 11% growth.

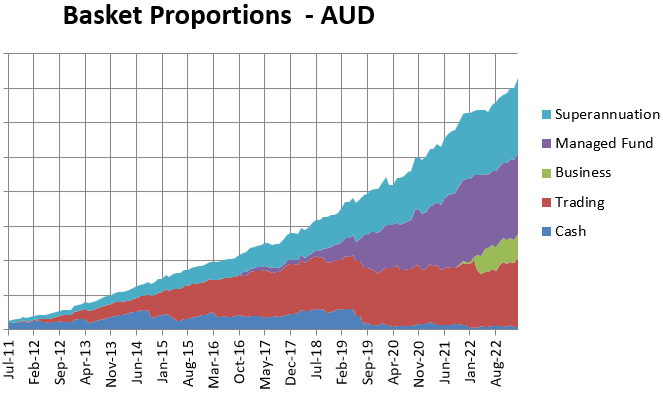

For reference, our portfolio consists of,

Self – sustenance ratio

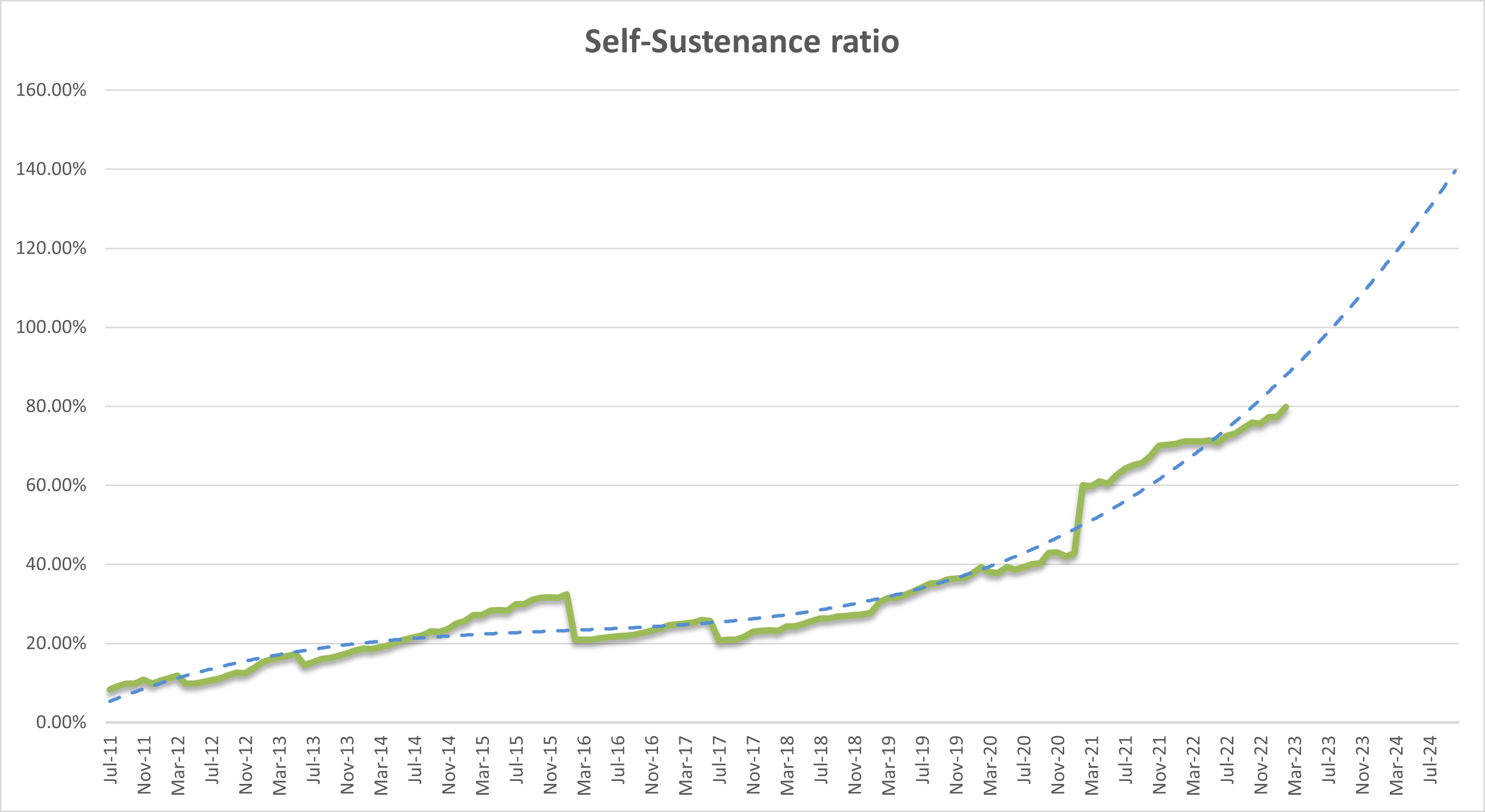

Our self-sustenance ratio is on track to reach 100% by July 2023! We have splurged on a local holiday during summer, have already booked an overseas holiday for next month and still have another overseas holiday coming up sometime in July. This has pushed our projections a bit further ahead to July 2023, previously was May 2023. However, the projected timeline may be unrealistic, as it’s based on exponential regression. For readers who are not familiar with the ratio, I have explained and introduced the concept of self-sustenance ratio in one of my previous blogs.

Currently, it is a smidge below 80% i.e. 4% drawdown on our portfolio would fund 80% of our annual living expenses (including housing, holidays, etc).

Expense summary

In my previous post, I put down my thoughts on a tool, HomeBank, that would replace PocketBook to help me track my expenses. HomeBank turned out to be clunky and difficult to manage. There are a few online tools available but they wanted me to subscribe to premium service to sync my bank transactions. An exception was Frollo. The only way to access Frollo platform is via the mobile app. Browser would have been great, but they do not offer browser-based version. I switched from HomeBank to Frollo. It ticks the boxes for now but I will keep an eye out for a good expense tracking tool.

Do let me know if you found these posts helpful. If you have recommendation for tools to manage your expenses, portfolio, etc please let me know in the comments section below.

Thanks for the tip on Frollo, been looking for a pocketbook replacement

You are welcome! Glad this post has been helpful. Just a note abt Frollo, if you want to sync with some banks and financial institutions then you will have provide “consent” to Frollo to receive your transactional data from the banks. This consent expires every 3 months (atleast with CBA it expires every 3 months). So, every 3 months, you have to look out for notification and re-consent again.