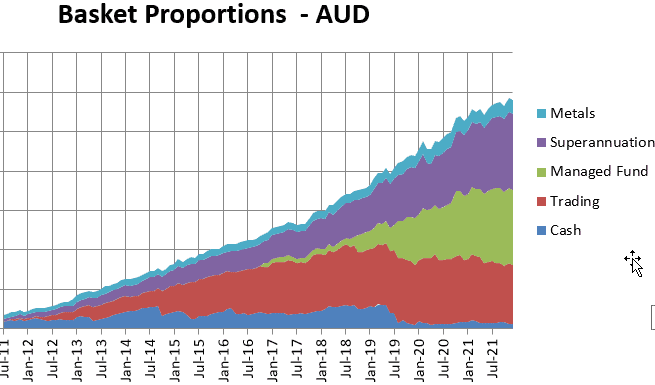

My overall allocations have not changed much at all. I have been piling into a boutique fund and an Vanguard account for a few months now. My goal was to reach a specific $-figure in the boutique fund and we reached that goal this month. Therefore from now on, I will be piling mostly into the Vanguard account which is currently a proxy for funds required to acquire a business. And some tiny fraction will be redirected into our active trading account. We were salary sacrificing to super, on top of the mandated contribution, however from now on most likely only one of us might salary sacrifice to super. Both of us have some unused concessional contributions which is eligible for carry-forward, which is handy to have.

Next couple of weeks will be interesting in the financial markets as the equities market have woken up to the fact that rate rises are certain and Fed is not jawboning anymore. My hypothesis is, the equity markets will correct and reach the bottom before the actual rate rises. I have 50% allocation to fixed income & cash in our super accounts, if equity markets fall considerably then I might reduce the allocation to fixed income & cash to 5%.

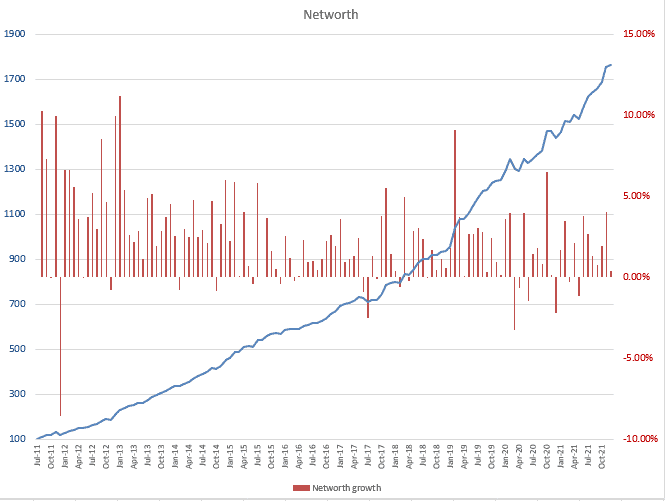

Below is our networth index chart. If you had $100 as of July 2011, it would be $1760 as of December 2021. This is the most simplistic index ever. Volatility in 2020 appears to be greater than 2021. Compared to a year ago (i.e. December 2020), the index has grown from $1440 to $1760, a healthy 22% growth.

For reference, our portfolio consists of,

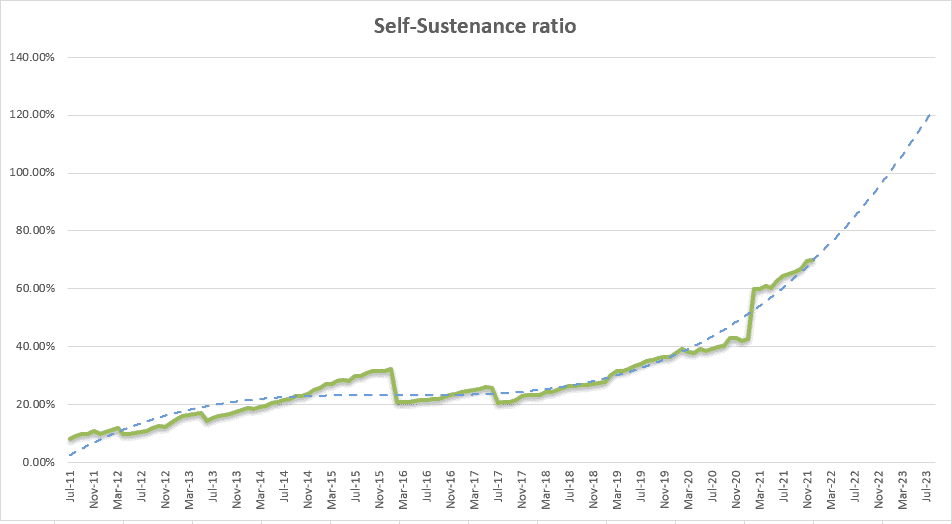

Self – sustenance ratio

Our self-sustenance ratio is on track to reach 100% by March 2023. I have explained and introduced the concept of self-sustenance ratio in one of my previous blogs. Currently, it is a smidge under 70% i.e. 4% drawdown on our portfolio would fund 70% of our annual living expenses (including housing, holidays, etc). It is quite a weird feeling looking back to July 2011 when I was starting on this journey and my initial thought was ‘there is no point’. But with some ‘just do it’ attitude and perseverance we will, by March 2023, in 12 short years reach a self-sustenance ratio of 100%! Not a bad feat, in my humble opinion.

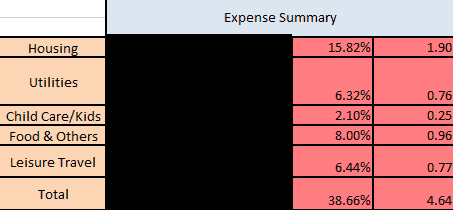

Expense summary

I am sharing our expense summary in this post for the first time. Expense summary does not change too drastically too often, so I will refrain from repeating this over and over again in subsequent posts.

Our largest expense is Housing cost, in our case it is the rent, at 15.82% followed by Food & others at 8% of our after-tax income. I do not accurately track these spending. We have a Pocketbook account that is connected to our credit cards and savings accounts and I analyse 6 months worth of spending once in a while and adjust the $. We have not set rules on how much to spend or on what, we spend on whatever we think is required/necessary/want and then analyse the numbers after-the-fact. Only exception to this rule is Leisure Travel as we mandatorily allocate a certain amount per year that includes funding for a local and an overseas holiday. On a monthly basis housing, utilities and leisure travel are mostly constant, only variables are child care/kids and food & others.

That’s it for now.