I have been meaning to write a networth update post but kept pushing it further and further ahead. But it is here, finally!

Its coming close to more than 2 years since we bought a business (in partnership with someone). The business is progressing well but we are facing an uphill task in scaling the business. We are launching couple of new products into the market, few have asked for samples to test but have not yet converted to tangible orders. Our online store is chugging along fine, we lost another B2B customer. We started another online store that offers different products for a different vertical. I had a some interesting conversations with “product sourcing agents”. There is a huge swathes of businesses whose only job is to source products/manufacturers from other countries, interestingly enough they are all usually based out of Northern Europe and Scandinavia. Instead of having a sourcing department, small businesses could outsource the job of sourcing departments.

We have been diverting 100% of our savings into IBKR. I had opened an Vangaurd account to trade ETFs and build up funds for a specific purpose, paying down the balloon payment on our 1 year novated lease vehicle. Payment is due in a month or so, so we are going to empty that account. During this process, I concluded that Betashares Direct might be a lucrative option compared to Vangaurd. My reasons being, Betashares gives access to all ETFs whereas Vangaurd restricts to their own ETFs, no brokerage on Betashares vs Vangaurd charges $9 for selling ETFs and Betashares allows buying/selling of fractional ETFs . I applied for early access to Betashares Direct and started the ETF portfolio on it with regular ‘auto-pilot’.

We are now fully deployed in Superannuation and hold zero cash. The boutique funds are chugging along well. I am trying to diversify into another boutique fund based out of Europe. Application process is bit of a mine-field due to plethora of EU anti-money laundering and other legislations. My accountant is not his cheerful self because even he has to provide a fair few documents from his behalf to satisfy the regulatory authority. This is an application process and after that there is a decision process so there is no guarantee that the fund will accommodate us.

I have reduced frequency of trading even more compared to last time. I am still bagholding those shitcos, BBUS and BBOZ. IWM and SLV positions came good. My monster VIX option positions got smoked to no end and short CBA position got burnt to smithereens. Currently, long PYPL and short NVDA. I went short NVDA at $888, so thats trending well at the moment. PYPL not so much but PYPL is not a short term trade. I am trading a bit of AUDUSD CFD predominantly on the long side. My trading account is 90% USD and 10% AUD, when AUD is falling I benefit and I wanted to benefit on occasions where AUD appreciates hence trading AUDUSD CFD on long side.

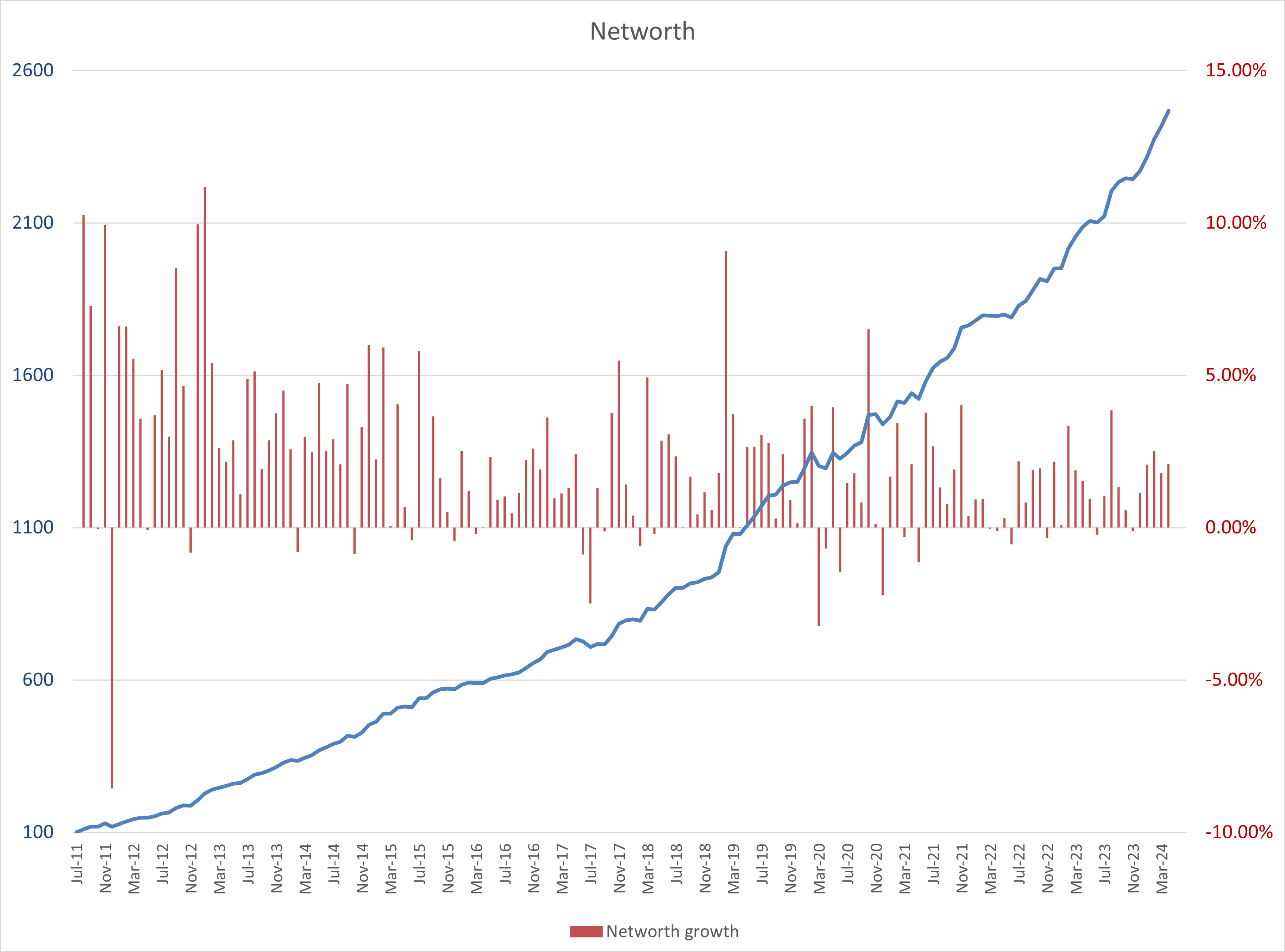

Below is our networth index chart. Compared to a year ago (i.e. April 2023), the index has grown from $2086 to $2467, a healthy 18% growth.

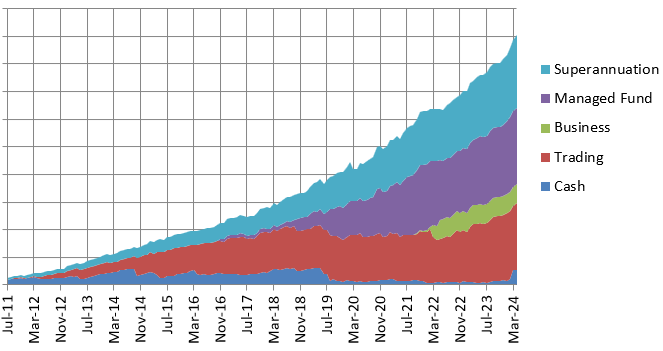

For reference, our portfolio consists of,

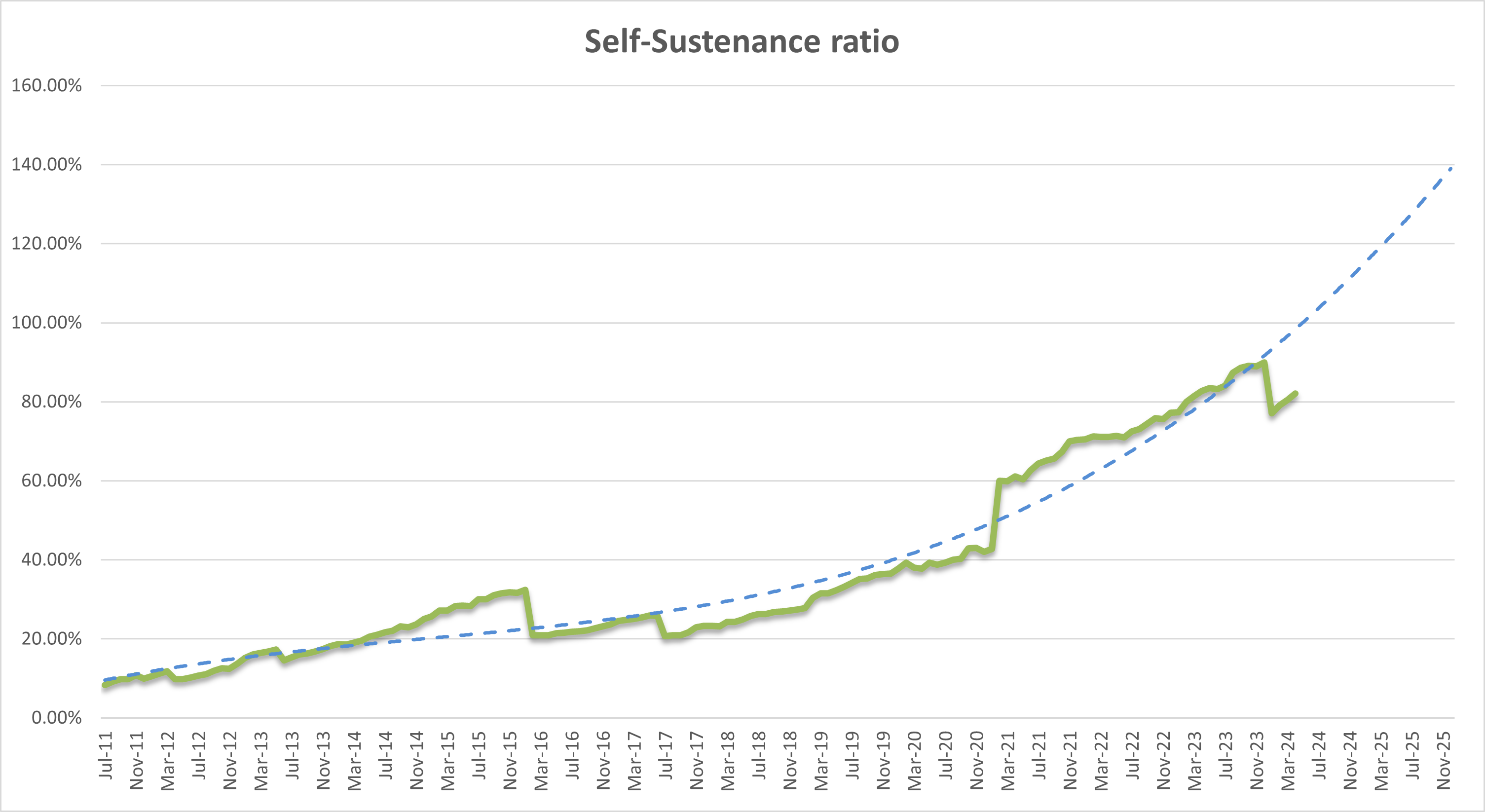

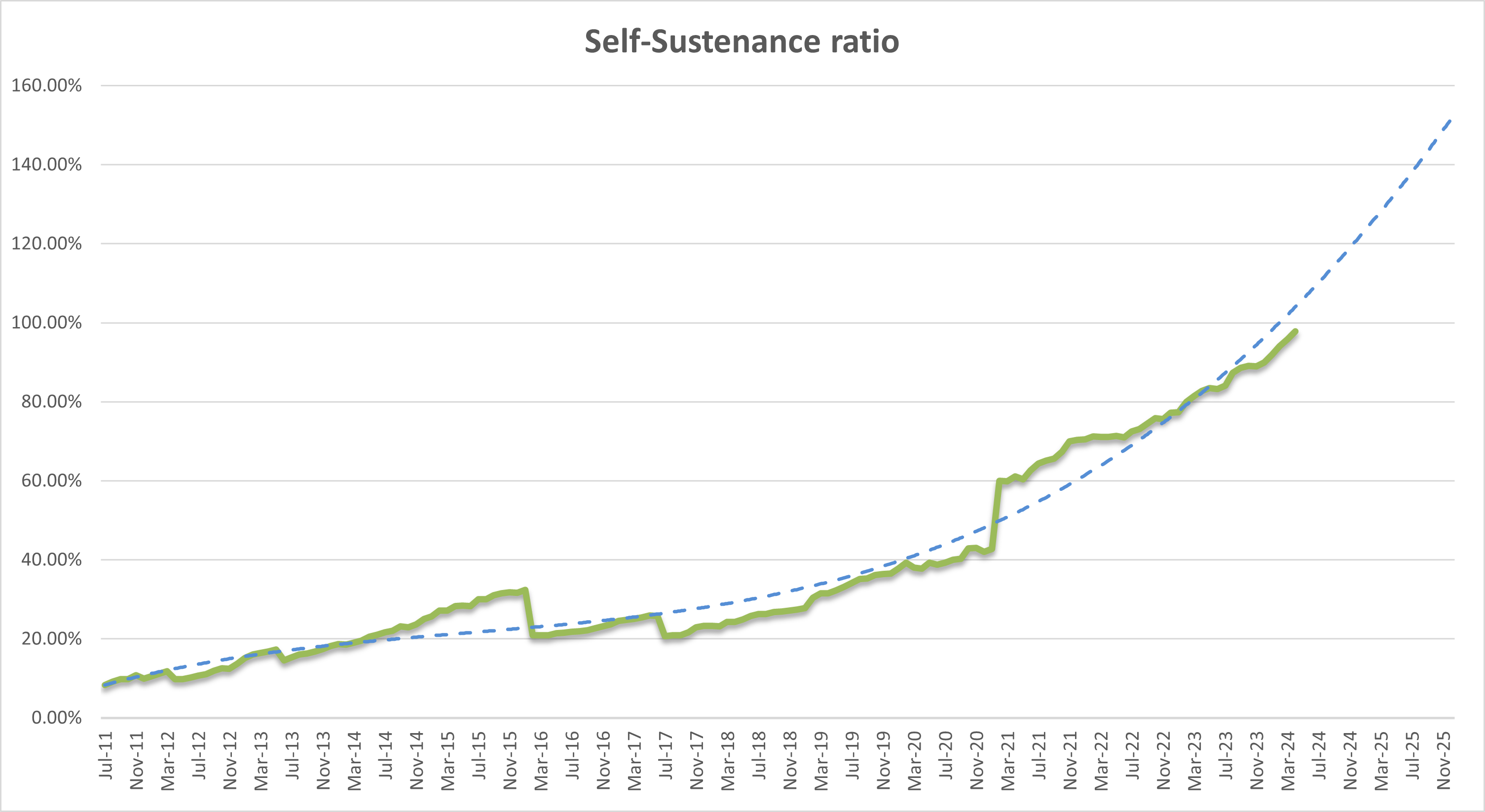

Self – sustenance ratio

Our self-sustenance ratio “was” on track to reach 100% by July 2023. However, as of today we are estimated to reach that 100% by July 2024! This is because we ended up splurging on an expensive trip to United States, a few local trips and upgraded my partner’s car. I think, the projected timeline may be unrealistic as we might be getting ourselves into another expensive commitment. Living life as they call it :-). For readers who are not familiar with the ratio, I have explained and introduced the concept of self-sustenance ratio in one of my previous blogs.

Currently, it is a smidge below 98% i.e. 4% drawdown on our portfolio would fund 98% of our annual living expenses (including housing, holidays, etc). I continue to track our spending using Frollo and I can clearly see that our expenses have easily gone 20% higher or more across all categories even though we have not changed our spending patterns. That makes me think whether I need to update the annual living expenses figure for the sustenance ratio? Maybe I should.

Until next time.

Update 30th April 2024:

I have updated the annual living expenses figure (starting from Jan 2024) used for the sustenance ratio. After this update, it may be possible to reach 100% by July 2025.