This is a MS Excel based calculator that helps you gauge the difference it would make to your wealth, with debt-recycling and without debt-recycling. Debt-recycling is a concept wherein, you recycle existing non-tax-deductible debt into tax-deductible debt. Debt recycling is not about increasing your debt instead it is about harnessing the tax advantages provided by the Australian taxation law to grow your wealth.

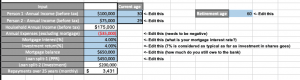

The calculator is fairly easy to use, you need to enter your inputs into the ‘blue’ fields as shown below.

The inputs required are, your

- before-tax income and age (e.g: $100000, 30 )

- spouse’s before-tax income and age. If you don’t have a spouse, enter ‘0’. (e.g: $75000, 29)

- annual living expenses (e.g.: -$35000)

- mortgage interest rate and investment return rate (e.g: 4%, 4%)

- mortgage balance and how do you intend to split the mortgage balance (e.g: $650000, $450000)

- retirement age (e.g: 60)

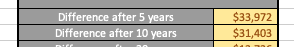

For the example inputs provided, one would be better off by $33,972 after first five years with debt-recycling when compared to without debt-recycling.

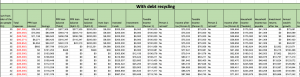

The worksheet also displays year-on-year working calculations to help you understand the calculations, etc.

I am not a financial advisor therefore I am not in a position to give you financial advice. Please consult a registered financial advisor to understand whether debt-recycling is an appropriate strategy for your circumstances.

The calculator costs AUD 30 (incl. GST). You are free to use for personal or commercial use however as per license conditions you are not allowed to make copies and/or distribute copies.

Download: